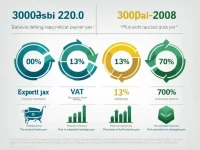

34dichlorotrifluorotoluene Gains Traction for Market and Tax Benefits

This article provides a detailed analysis of the industry potential and tax rate information for 3,4-dichlorotrifluorotoluene (HS code 2903692000). It emphasizes the tax advantages of this compound in international trade, offering guidance for corporate compliance and cost control, and helping companies seize market opportunities within the chemical industry.